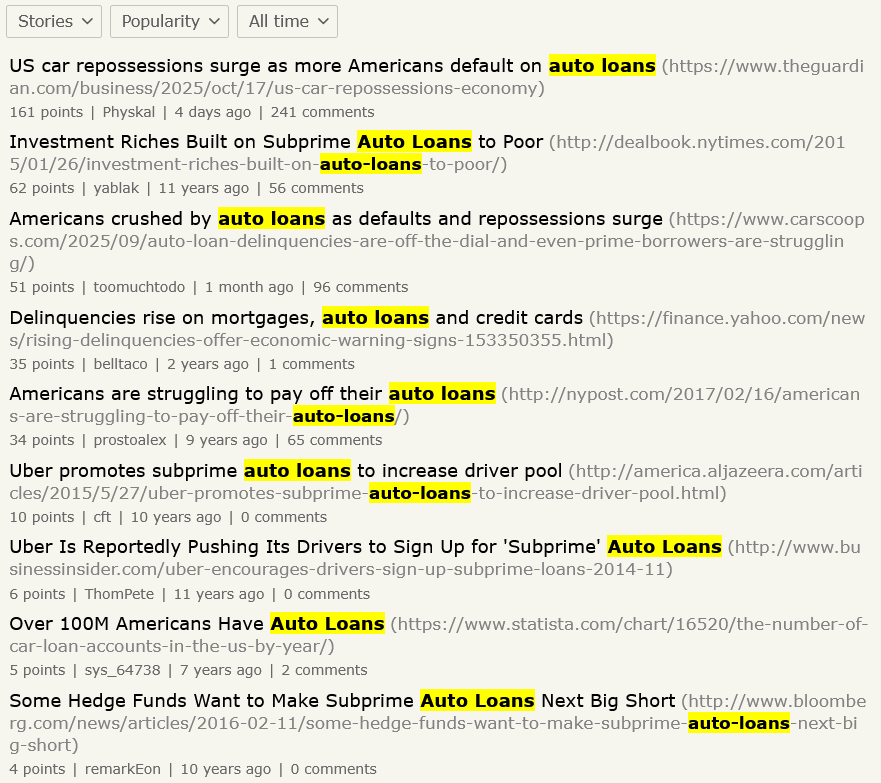

Many years ago I asked on one social media site or another what the next big crash would come from after 2008. Subprime auto loans were the top suggestion.

August 2025:

September 2025:

October 2025:

And just two days before I drafted this article, a major subprime auto loan company went under.

We're seeing a flurry of headlines in the last month about subprime auto loans. The problem is: this is a recurring headline, year after year, and no one who made a bet based on one would have won or lost by now.

Let's review.

January 2015:

March 2016:

January 2017, it's on people's minds:

October 2022, over 5 years later:

November 2023, a year later:

Let me make this clear in case it sounds like I'm downplaying the problem: subprime auto loans are a problem. But the thing that kicks the economy in front of the bus is generally not something you see in headlines before it happens.

As I write this, the US government is shut down. Federal workers are furloughed. SNAP benefits are expected to run out, and November payments might be delayed just in time for the holiday season. Like 2008, we're looking at a sequence of events unfolding that could be the thing to kick the economy over the ledge.

Most likely, someone will blink, a bill will be passed, and we'll all memory hole this until the next one. If I had money to bet, it would be on the failure of one of the big chatbot companies drawing fear and scrutiny to the AI market, leading to a bank failure, leading to long-deferred scrutiny of market fundamentals across the economy.

Consider 2020 and the early days of covid-19: businesses suddenly discovered a capacity for allowing working from home. Grocery delivery took off, and you can call an Uber for the big stuff. Commercial real estate took a huge hit because its value is often used as the basis for loans to buy more real estate. Drop the rents or sell for less to respond to structural changes, the value goes down, and triggers for things people like to avoid written into debt terms go off. So they don't, and you get headlines about apocalyptic office parks.

When the catalyst comes, will people be as resistant as in 2008 to letting their cars go when economic pressure forces them to make hard decisions? Will return to office prove to be a short-lived thing? If so, will it accelerate the long trend toward urbanization? If that happens and office work moves to corner shops and downtown coworking spaces, how long can real estate companies pretend like their massive office complexes in the middle of nowhere are worth anything with no one in them and no viable way to redevelop them for other things?

No one knows until the music stops. When it does, it will take years to shake out, and it will be some thing only industry insiders knew anything about. There will have been warnings, but insiders get caught up in the boom and, if they see the bust coming, don't know how to avoid it.

What do do instead of watching the headlines

- Diversify skills: specialization is great when times are good, but requires you to be among the best at what you do. Becoming more adaptable will serve you better in the long run. You might not be the best musician or writer, for example, but you can combine them in a unique way that appeals to enough people to provide a little extra money

- Mutual aid: Get to know the people and organizations already supporting your community. They aren't all religious. Probably.

- Community: Find your local Discord servers, blogs, and forums. At least have an idea of what's going on. Local Facebook groups are dominated by people posting ads even when the group explicitly forbids it, and Nextdoor is mostly lost pets and people calling cops on neighbors they never met.

You might notice I didn't say anything about "networking." That's fine to do, but it should flow naturally from the other things. When you put out notice you need a job, food, or just someone to hang out with, you'll do better with people who already know you. Networking is a good way to get an introduction for an interview. Being known for what you do is a good way to get offered a position created for you. And sometimes people have too much of one thing or too little of another and are happy to swap or give away.

If I were going to stick to one recommendation, it would be to read Carl Sagan's Demon-Haunted World. It's what set me on the path to developing a healthy skepticism built on empathy and patience rather than scorn and cynicism. Hate never changed a mind for the better, and skepticism is why I don't flap in the wind of headlines.

The next is 1984. George Orwell was a keen observer of politics and human nature. The book is often mistaken as a look at a possible future. In reality, it's a collection of models of political tendencies. After you read it, the difference between people who refer to the book but haven't read it and people who have is stark. You'll see real-world examples that could have inspired Syme's monologue on Newspeak everywhere.